On-chain statistics indicate that the Bitcoin Hashrate has experienced a decline recently, which might suggest that miners are skeptical about the longevity of the asset’s surge.

Bitcoin Mining Hashrate Has Decreased Since Its Record High

The “Hashrate” denotes a metric that measures the total computational power of miners currently connected to the Bitcoin network. The value of this indicator is quantified in hashes per second (H/s) or more conveniently, terahashes per second (TH/s).

An increase in this metric signifies that new miners are entering the network, while existing miners are expanding their operations. Such a trend suggests that blockchain represents a profitable avenue for these validators.

Conversely, a declining value implies that some miners have opted to disband their rigs from the network, potentially due to an inability to remain profitable.

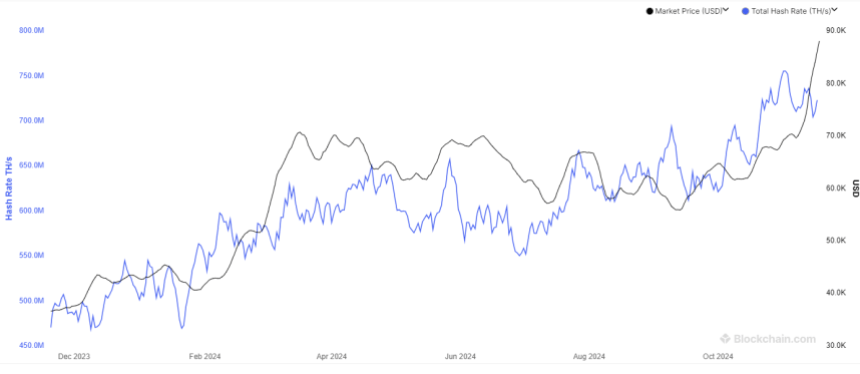

Now, here’s a chart illustrating the trend in the 7-day average of the Bitcoin Mining Hashrate over the preceding year:

As depicted in the above graph, the 7-day average Bitcoin Hashrate saw a substantial increase earlier and reached new heights. However, the metric has fallen since hitting nearly the 755 million TH/s level at the beginning of this month.

The previous uptrend in the indicator was a consequence of the favorable price movements the asset had been experiencing, as the price is directly associated with the revenue of miners.

These chain validators have two primary sources of income: transaction fees and block subsidies. The former is influenced by network activity and can vary significantly from day to day. In contrast, the latter comes with specific limitations attached.

The block subsidy remains constant in BTC value for roughly four years, at which point an event known as the Halving reduces it by half. These rewards are distributed at a relatively steady rate, making the daily block subsidy income for miners in BTC terms consistently predictable.

Nonetheless, one factor is subject to change, specifically the USD value of these rewards. Whenever the price increases, so too does the block subsidy revenue for miners. This is why the Hashrate often experiences growth during bullish trends.

Recently, Bitcoin has been reaching new peaks, yet the Hashrate has interestingly remained subdued. The indicator is around 723 million, indicating a decline of over 4% since its peak. This trend may suggest that miners foresee challenges ahead for the current rally.

BTC Price

At the moment of this writing, Bitcoin is hovering around $91,900, reflecting an increase of over 8% in the past week.